“Much that once was is lost, for none now live who remember it.”

–The Fellowship of the Ring, J.R.R. Tolkien

F

or the better part of my life, the interest in my family history and Genealogy didn’t exist. Prior generations rarely, if ever, willingly talked about any of it. It was always about the moment, or the Americanization of their day to day lives. When they did, without the context of years and perhaps over a holiday dinner, it held little meaning to a young child who would come to only hear the name once. I had more pressing matters going on in my young life. Did I really need a third helping, or could I be excused to go watch television?

Time carried on and the decades passed. I now have a family of my own, turning gray more so than not. One comes to appreciate life in ways one cannot fathom until they see their own child growing within the blink of an eye. People pass, without ever having the chance to ask the questions I have now, because I didn’t have them then. Stories of value lost to time, discarded or hidden because of relationships turning sour. Never written down. Never passed on. I have since asked these questions of those still with us, finding out what I could, piecing together the broken bits into whole. But that’s not where my journey started.

Time carried on and the decades passed. I now have a family of my own, turning gray more so than not. One comes to appreciate life in ways one cannot fathom until they see their own child growing within the blink of an eye. People pass, without ever having the chance to ask the questions I have now, because I didn’t have them then. Stories of value lost to time, discarded or hidden because of relationships turning sour. Never written down. Never passed on. I have since asked these questions of those still with us, finding out what I could, piecing together the broken bits into whole. But that’s not where my journey started.

I’ve oft wondered about traditions or customs and, in most cases, the lack thereof. Having known anything past my grandparent’s generation, except at face value, there was, in a sense…nothing. Nothing past the long-ago, fading first hand experiences I had with only some relatives.

A few years back, I made the choice to have my DNA tested. For various and wide-ranging reasons, this is not something that many feel comfortable doing. That is a whole other topic of discussion. While it may not be critical to the journey of some, it was to mine.

From there, my journey began.

Who I thought I was, what I always knew to be truth but never actually related to, was not the most of who I actually am. My surname was only a very small piece. Who I actually was, and the longing I felt inside, led me to something else completely unexpected.

Who I thought I was, what I always knew to be truth but never actually related to, was not the most of who I actually am.

The revelation of my genealogy became an elaborate puzzle. A jumble pile of information in need of sorting. It was a quest defined by a map leading to branches and paths that faded back into a Mirkwood haze. I started where many of us usually do. With what we know. The border of what makes us, well…us. Sometimes asking questions leads to more questions, and perhaps disagreements. There wasn’t a defining corner piece in sight. But that is where I started. There’s this idea of writing what you know. So that’s what I did.

From there, the adventure only got wilder. Literally. These may sound like I’m telling tales, and I certainly thought that myself at the time, but I can assure you that I am not. Jumping from branch to branch, this way and that, multiple tabs open at times. A cup of coffee in hand. Sometimes tea.

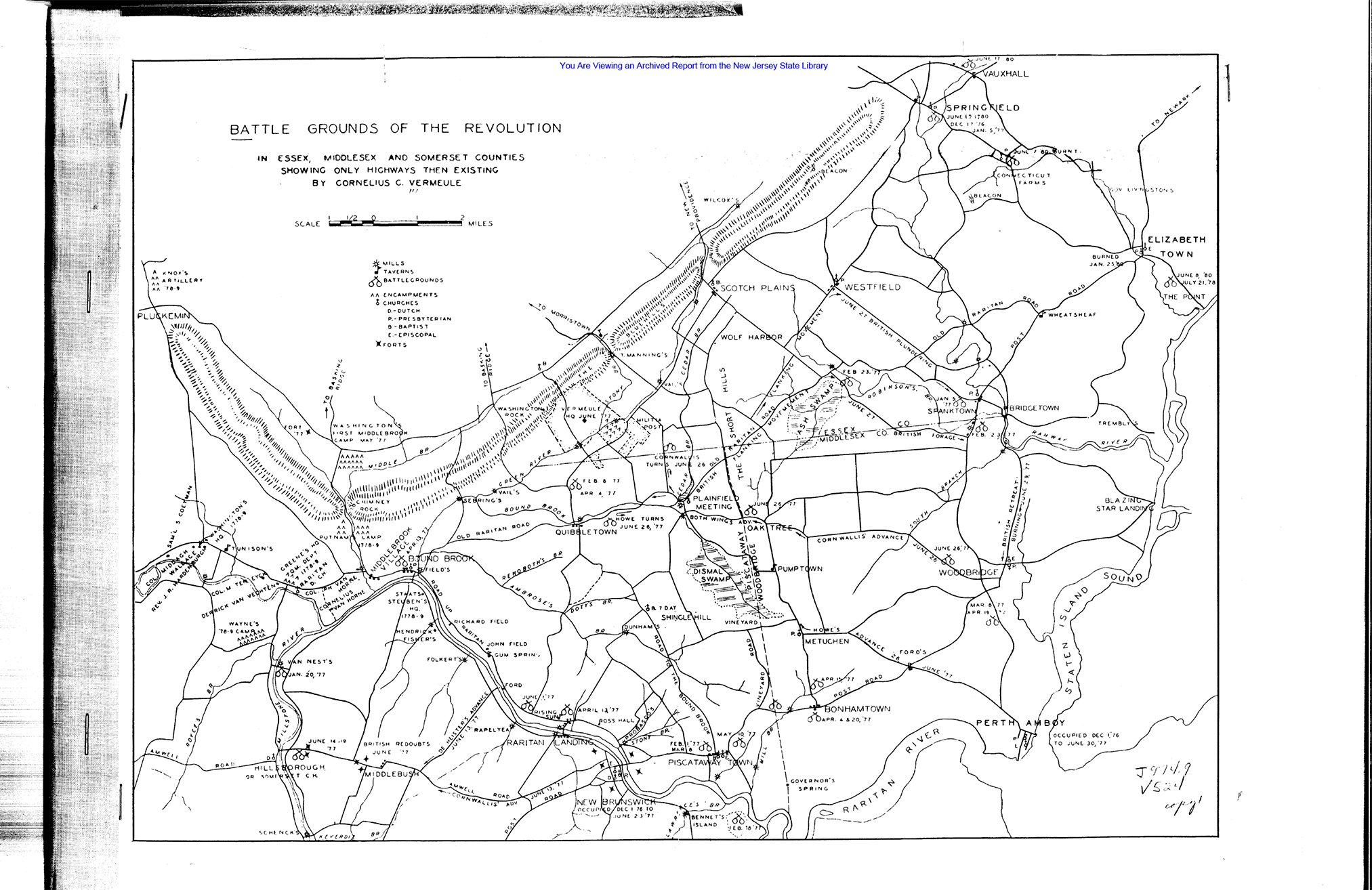

Revolutionary War Great Grandfathers who founded towns. Indigenous Great Grandmothers, while not of my actual DNA, revealed insights to questions I’ve had through the years. A farmer that in part founded New Amsterdam. Coal Miners. A WWII veteran who stormed the beaches of Normandy on D-Day, going on to help liberate concentration camps. There were stories of Big Bands. Carpathian Vampires…well, that one was a family story that evolved and after all this time it’s one I cannot verify. But there might still be a castle out there with my name etched in a cornerstone.

In six-month’s time, give or take, I had discovered more than in all of the previous decades of my life. And this was, except for the vampires, only taking into account America. The European side was just as poignant.

My entire world had changed.

There was so much lost, yet now gained. Something as simple as the back of an old photograph can reveal a nickname you never knew existed.

It gets to the point where you question the data. You should question the data, but more so to the point of verifying it as much as possible. People existed. They were real. Names on record however, were at times written different ways, poorly transcribed, or changed on the voyage over to prevent discrimination. One looking for answers is sometimes too quick to accept, if only because it would verify a want or need. Even if they weren’t actually an ancestor. I’ve passed so many family trees where everything sounded too good to be true. Some you hoped weren’t.

I don’t have an Uncle Al.

Oh, he’s not a real uncle?

Just stayed around for a few months that one time?

Thankfully so.

Some filled their boughs with names that, in the same search, offered other trunks with completely different relationships. Branches were sparse otherwise. A sense of sadness took over, but there was nothing I could do. Proud Oaks turned to Ash rather quickly. Frustration set in at times. Spending three or four hours searching well into the darkest of night. Ending up, ultimately, with nothing but the dawn.

But if I’ve learned anything in these past years, it’s the need to stay the course and use due diligence.

You might just find that one newspaper clipping, only a few paragraphs, connecting your Great Grandmother back to her home country. Information that nobody living knew, and only knowing of her from their brief flashes of memory when they were young. But then just as abrupt as when you found it, the path once again turned hazy, because that’s what happened to the borders in those countries. Depending on the year, she could come from one or another. With no way to tell unless I journeyed to the local towns myself, that is if the records were even intact after all this time.

Maybe one day.

While it may never be complete, the picture that made up my map was more elaborate than when I started. Sometimes a missing piece may have fallen to the floor, or kicked under a refrigerator, and lost to time. Sometimes what was lost is found again. Sometimes not. A name reveals itself, if you’re lucky, but nothing of who the person was. Nothing of their story. No context. The trials and tribulations of their lives. For me, the adventure started with finding out who I was, but it eventually became about who they were as well. For every Samwise there could be, there was also a Saruman.

Stories coalesce.

New traditions, many based around the holidays, are made.

A hole that I felt, for the majority of my life, started to fill. Visits out of interest to local Crossroads of the American Revolution Heritage sites brought on a new meaning. Perhaps the reason. I had the privilege of meeting very recent immigrants and their first-generation children during one of these tours. They were from the same home country I had just discovered of my own. Just as eager to find out about the customs and history here in America as I was eager to find out theirs. One day they would travel back so their parents could meet their children, when it was safe to return.

Context changes everything and puts everything into its proper perspective.

As the years go on, I’ve refined the recipes of our new traditions. The same is true in my Genealogy research. I started to notice what I didn’t before, avoiding the pitfalls and dead ends. Faster than Han flew the Kessel Run in that piece of junk. More mileage than years, and a few more grey hairs have grown-in since I took that first step. As time goes on, more of my story unfolds through their stories and updates.

If this were a trilogy, I haven’t even made it out of Hobbiton. Yes, I’m very much aware and acknowledge that I’m mixing sacred trilogy references in all of this. But in a sense, that is who we are. A mixture of a great many things. These references in particular are all grand adventures. With their own mix of larger-than-life characters, from many different far-off lands that I have found on my own journey.

My adventure has only just begun.

There are many resources for you to start your own journey, if the feeling ever catches you one day. At the state and local level, there are various archives, town historians, your public libraries, and churches that can help you find more information. I’ve discovered just as many of those sources, not all known, as I have my own history, along the way. You can also visit the New Jersey State Library, both in person and online, to see the Genealogy Collection and resources.

Thank you to Judy Russell, The Legal Genealogist, for an extremely informative and resourceful presentation on copyright and it’s implications for genealogists. With the wide-variety of records and works out there, many of which digitally available, it is even more important that we all take the time to learn about copyright and take all the necessary steps to ensure that we are in compliance with copyright law. There are a lot of myths surrounding copyright, some of which we assume to be true, that can land us in hot water. Let’s dive in and learn the truth about copyright!

Thank you to Judy Russell, The Legal Genealogist, for an extremely informative and resourceful presentation on copyright and it’s implications for genealogists. With the wide-variety of records and works out there, many of which digitally available, it is even more important that we all take the time to learn about copyright and take all the necessary steps to ensure that we are in compliance with copyright law. There are a lot of myths surrounding copyright, some of which we assume to be true, that can land us in hot water. Let’s dive in and learn the truth about copyright!

Thank you to retired FBI agent Jeff Lanza for his presentation on preventative methods from becoming a victim of identity thefy and cybercrimes. Jeff’s work and experiences provide a unique insight into the ever-growing problem of staying safe online and protecting your identity. Criminals are always coming up with new ways to steal your identity and money, but by practicing some simple safeguards, you can significantly lower your risk of becoming a victim.

Thank you to retired FBI agent Jeff Lanza for his presentation on preventative methods from becoming a victim of identity thefy and cybercrimes. Jeff’s work and experiences provide a unique insight into the ever-growing problem of staying safe online and protecting your identity. Criminals are always coming up with new ways to steal your identity and money, but by practicing some simple safeguards, you can significantly lower your risk of becoming a victim.