Thank you to Marcial Hernandez Jr. from the Social Security Administration for deconstructing the many aspects of Social Security. There are many considerations regarding Social Security and because every person’s situation is different, it is important to identify the conditions that are applicable to you.

Determining Your Benefits

A common misconception regarding Social Security is that you get all of the money that you pay into Social Security. While that may end up being the case, your eligibility and the amount you can collect is made up of a variety of factors. First, Social Security eligibility is determined by the number of “credits” you earned while working. For each $1,640 you earn in a year, you receive 1 “credit”, up to a maximum of 4 credits per year. In order to be eligible to collect Social Security Retirement benefits, you must have earned at least 40 credits (10 years of work) and be 62 years of age or older. The amount of your monetary benefit is based on:

- Your wages, adjusted for changes in wage levels over time

- The monthly average of your 35 highest earnings years

- Your average indexed monthly earnings

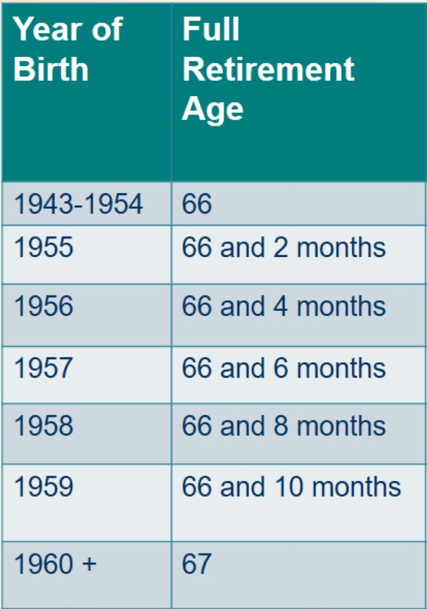

Additionally, the amount of money you can collect per month is also determined by your age when you apply for Social Security. If you take your Social Security before your Full Retirement Age, as determined by the chart below, you will receive less than your full amount, up to 25% less if you claim at age 62. If you claim at your full retirement age, you will receive your full monthly benefit. If you wait until age 70, which is the last year you pay into Social Security, you will receive more than your Full Retirement Age benefit.

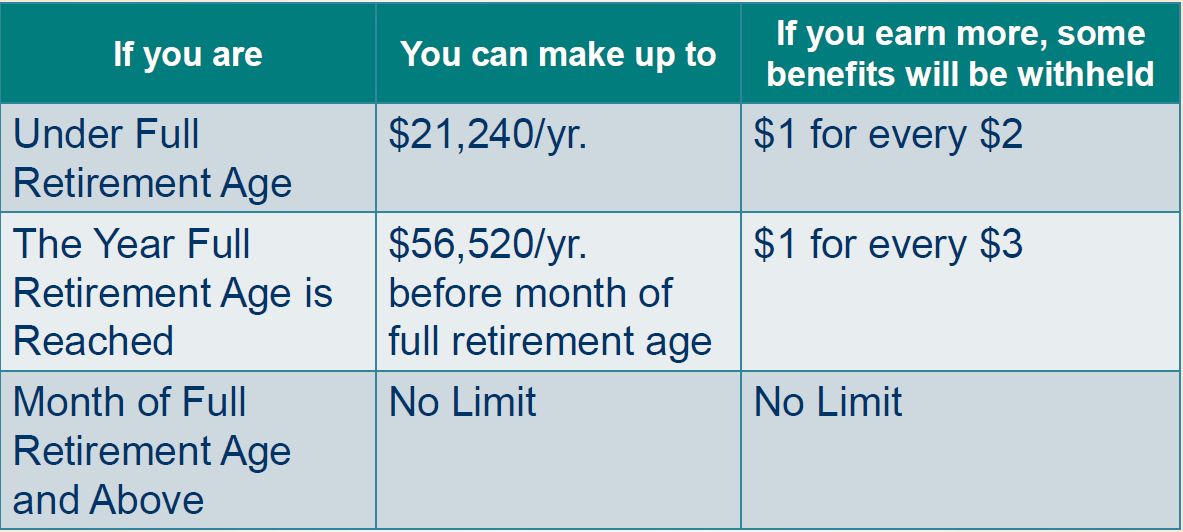

While Social Security is designed to help people in retirement, many people still continue to work after receiving Social Security. Depending on your age and the amount you are making, you may have some of your benefits withheld; please see the chart below for more information:

It is recommended that before you file for Social Security, use their Retirement Estimator to get a better sense of what your benefits might be.

Spousal Benefits

Outside of when to file for Social Security Retirement Benefits, the next most common questions deal with spousal benefits, for both current and divorced spouses. In general, spouses can receive 50% of their other’s spouses unreduced benefit. For example, if your spouse receives $1,000 as their unreduced benefit per month, then you are eligible to receive $500 by claiming under your spouse. However, if your individual benefit is more than 50% of your spouse’s, you will not receive any spousal benefits. If your individual benefit is below 50% of your spouse’s, you will receive the difference. There is a reduction if you are claiming spousal benefits before your Full Retirement Age, and your benefit payments do not reduce the amount your spouse will receive. Additionally, spousal benefits can be 100%, regardless of age, if the spouse is caring for a child under 16 or is disabled.

Divorced spouses can claim on their ex-spouses benefits, even if their ex-spouse remarried. First, divorced couples must have been married for at least 10 years for divorced spouses to claim on their ex-spouse. Also, the divorced spouse must be unmarried, age 62 or older, and would receive less money under their individual benefit than what the amount would be if claiming spousal benefits. Additionally, the ex-spouse must be entitled to Social Security retirement or disability benefits. Divorced spousal benefits do not count against the amount of money the ex-spouse can claim or their partner if remarried.

There is a caveat when attempting to claim either your benefits or spousal benefits if you turned 62 after January 1, 2016. Regardless of your age when claiming benefits, you must file for both individual and spousal benefits. Social Security will review your claims and award you whatever is highest. Known as “deemed filing”, this can be confusing given everyone’s unique situation so it is highly recommended you contact the SSA for more information.

One last element related to spousal benefits is Voluntary Suspension. If you take your retirement benefit, but then suspend it to earn delayed retirement credits, your spouse and any dependents will most likely stop receiving any benefits related to you as well. This does not apply to divorced spouses.

Auxiliary Benefits for Children

There are benefits available to children if certain criteria are met:

- A parent must be disabled or retired and entitled to SS benefits OR a parent must have died and worked long enough at a job to pay Social Security taxes

- Child must be unmarried

- Child must be younger than 18, 18-19 if they are a full-time student no higher than grade 12, or 18 or older and disabled, with the disability starting before age 22

Survivor Benefits

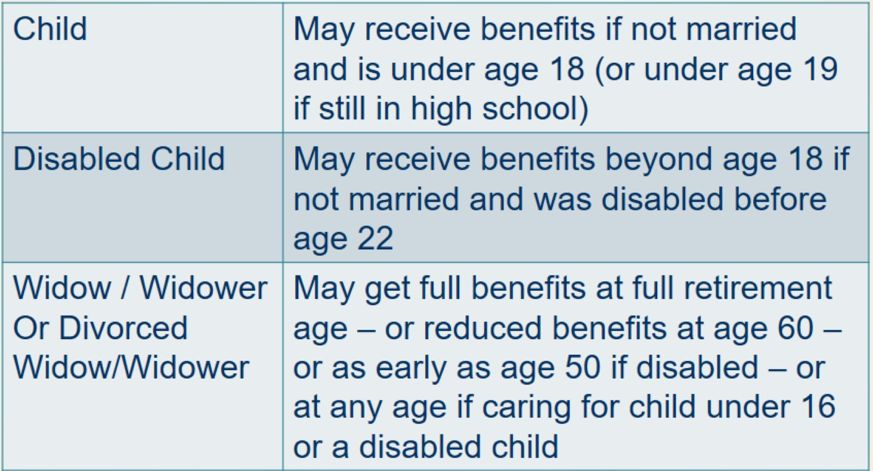

Social Security benefits are also available to widow/widowers, divorced widow/widowers, and children, including disabled children, should a spouse/ex-spouse/parent die. The chart below provides a brief summary of who is eligible and the criteria:

A spouse can claim survivor benefits at any age between 60 and Full Retirement Age. Specifically, spouses can receive 100% of the deceased worker’s unreduced benefits by waiting until Full Retirement Age to claim. At age 60, spouses can receive 71.5% of the full benefit, which will increase for each month the spouse waits to claim up to Full Retirement Age.

Other survivor benefits include Parent’s Benefits and a Lump Sum Death Payment. Parent’s benefits apply to a parent who is age 62 or older and was receiving at least 50% of their financial support from a son or daughter who died. The Lump Sum Death Payment is a one-time payment of $255 to the surviving spouse or child if they meet certain requirements.

Taxation of Social Security Benefits

You may be taxed on your Social Security benefits depending upon the total amount of your combined income. Your combined income is your Adjusted Gross Income + any Nontaxable Interest + 50% of our Social Security Benefits. Please review the following conditions to determine if you may be taxed on your Social Security benefits:

- Filing Individually – If combined income is between $25,000 and $34,000, you may pay income tax on up to 50% of your benefits. If over $34,000, up to 85% of your benefits may be taxable.

- Filing Jointly – If combined income is between $32,000 and $44,000, you may pay income tax on up to 50% of your benefits. If over $44,000, up to 85% of your benefits may be taxable.

- Filing Married, but Separate – You will probably pay taxes on your benefits regardless of combined income amount.

Medicare

Since Medicare is administered by the Social Security Administration and can tie into when you file for Social Security benefits, it is important to understand how Medicare works and what is covered. Medicare is divided into 4 parts:

- Part A – Hospital Insurance

- Part B – Medical Insurance (requires monthly paid premiums based off of your income)

- Part C – Medicare Advantage Plans

- Part D – Prescription Drug Plans

In order to qualify for Medicare, you must meet one of five eligibility requirements:

- Age 65

- Receive Social Security Disability Income for 24 months

- Suffer from ALS, commonly called Lou Gehrig’s Disease

- Suffer from kidney failure and undergo at least 2 months of dialysis

- Exposed to an environmental health hazard, such as asbestos

There are three enrollment periods for Medicare, based on your own personal situations:

- Initial Enrollment Period – 3 months before and after your 65th birthday

- General Enrollment Period – January 1 – March 31

- Special Enrollment Period – If 65 or older and covered under a group health plan based on you or your spouse’s current employer

Please note that if you are eligible for Medicare, but do not enroll and are claiming Social Security retirement benefits, you will pay a penalty should you enroll at a later date; the penalty is determined by the amount of time from your eligibility to when you enroll.

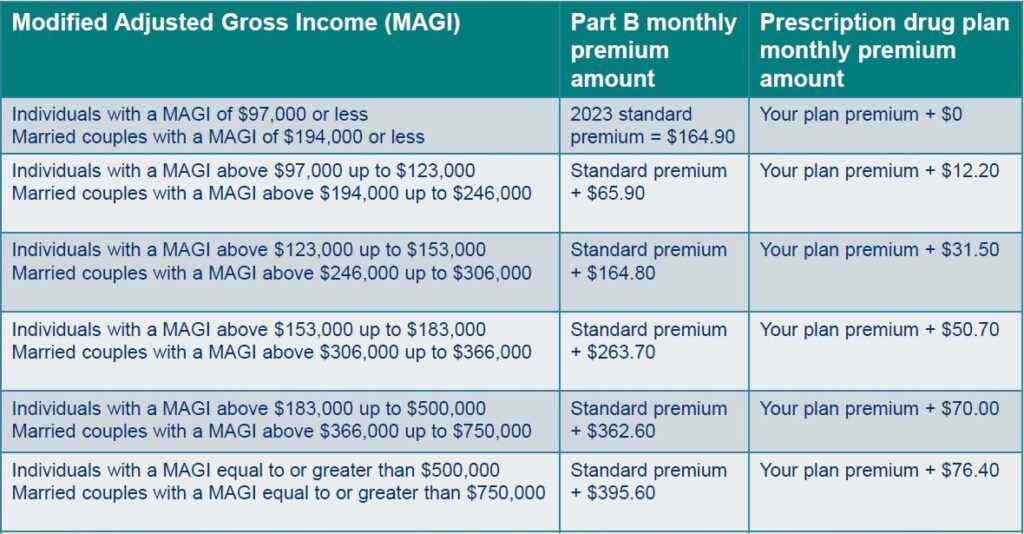

Medicare Parts A and B cover about 80% of all medical costs and are automatically activated once your enroll in Medicare. Parts C and D require other paid plans in addition to any Medicare premiums you are paying through Part B. The following chart displays the Medicare Part B Premiums for 2020:

More Information

If you have any questions, please reach out to Marcial Hernandez Jr. at marcial.hernandez.jr@ssa.gov or 732-815-6215. A recording of the webinar can be found at https://youtu.be/rWAA4FpQN3M. Please download copes of the handouts from the links below:

Presentation Slides

my Social Security Account

Online Services From the SSA

Retirement Benefits

When to Start Receiving Retirement Benefits